Top Sales Techniques Every Home Loan Advisor Should Know

Discover the most effective sales strategies that help home loan advisors connect with clients, build trust, and close more deals in the competitive 2025 market.

In 2025's fast-paced housing finance market, being a successful home loan advisor requires more than just product knowledgeit's about understanding clients' needs, offering personalized guidance, and building long-term relationships. As competition grows among lenders and digital platforms, advisors must adopt smart sales techniques to stand out. Here are the top strategies that can help you boost your sales performance and client satisfaction with support from Nimokey.

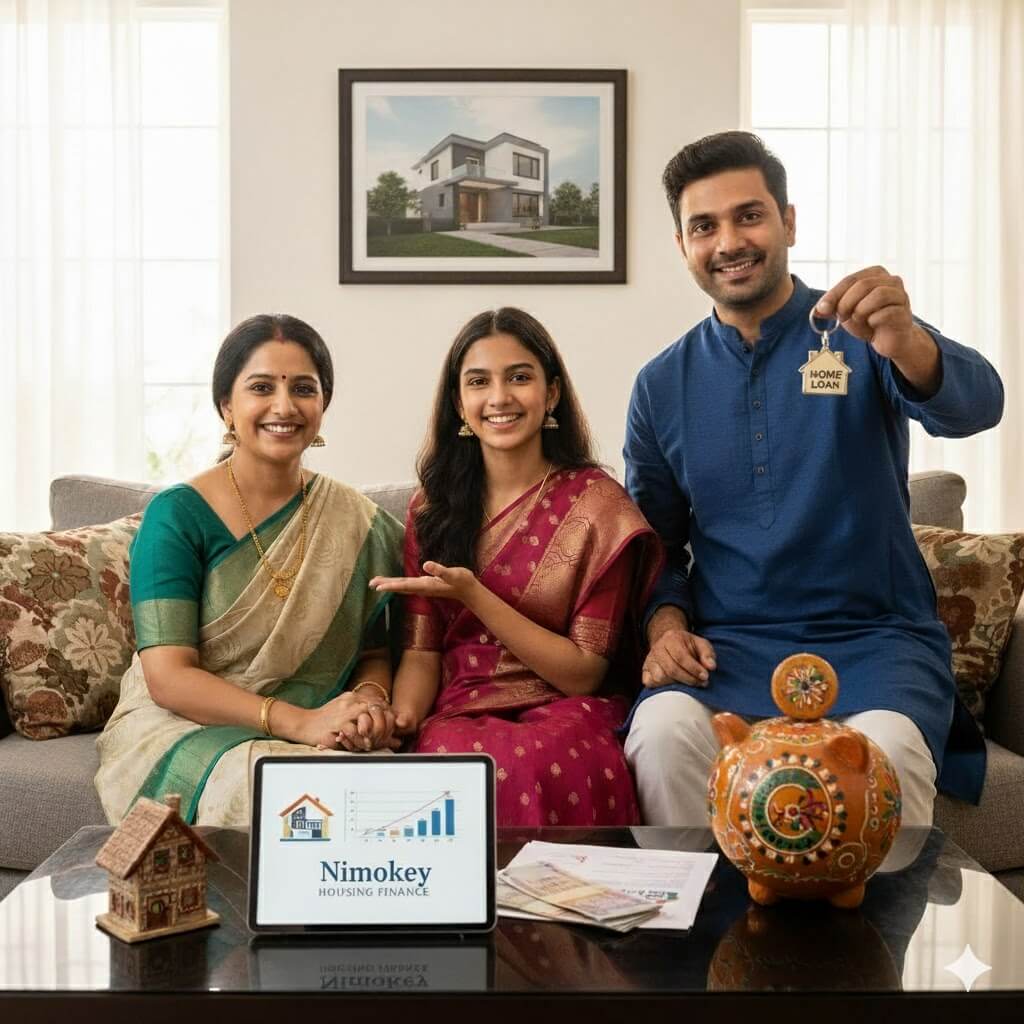

1. Focus on Relationship Building

Trust is the foundation of every successful loan transaction. Homebuyers often make emotional and long-term financial decisions, so creating genuine connections matters. Stay transparent, listen to their needs, and offer advice instead of just selling. Building rapport ensures repeat business and referralsyour most powerful sales tools.

2. Master Product Knowledge

Home loan advisors should thoroughly understand all available loan products, including fixed, floating, hybrid, and affordable housing loans. Being able to explain eligibility, EMI structures, and government incentives like PMAY or green home loan discounts gives you credibility and confidence during consultations.

3. Use Financial Tools to Demonstrate Value

Visual tools make complex concepts easy to grasp. Use Nimokey's Home Loan Calculator to show clients how different interest rates, tenures, and EMIs impact affordability. Empowering clients with clarity builds trust and helps them make faster, informed decisions.

4. Personalize Every Pitch

Every customer's financial background is unique. Analyze their income, credit score, repayment capacity, and future goals before suggesting loan options. Personalized solutionslike balance transfers for existing borrowers or hybrid-rate loans for flexibilitydemonstrate expertise and care.

5. Simplify the Application Process

Many borrowers feel overwhelmed by loan paperwork and technical jargon. Simplify it by offering step-by-step support, helping them collect necessary documents, and ensuring quick communication with the bank. Speed and clarity can make or break a sale in today's digital-first environment.

6. Leverage Technology for Efficiency

Digital tools and CRM systems can automate follow-ups, track leads, and manage client profiles efficiently. Nimokey's integrated digital lending ecosystem allows you to collaborate with multiple lenders, compare offers, and provide real-time loan recommendationshelping you close deals faster.

7. Highlight Benefits, Not Just Features

Instead of focusing on interest rates or loan types, emphasize the outcomeslike financial security, tax savings, or home ownership dreams. Storytelling works well; share success stories of previous clients who benefited from smart loan planning.

8. Overcome Objections with Data and Empathy

Common objections include high EMIs, long tenure, or interest rate fears. Address these concerns calmly using real numbers, EMI breakdowns, and comparisons. Showing empathy while backing your claims with data makes clients feel confident in their decision.

9. Stay Updated with Market Trends

Interest rate movements, RBI policies, and new financial products evolve constantly. Regularly updating your knowledge ensures you can position the right loan for the right customer at the right time. Subscribe to Nimokey insights to stay ahead in the market.

10. Follow Up and Maintain Relationships

Sales don't end with loan disbursal. Keep in touch with clients through annual reviews, updates about balance transfer offers, and financial advice. Satisfied customers often become long-term advocates and bring in valuable referrals.

Conclusion

Home loan advisory is about combining trust, knowledge, and communication. Advisors who focus on personalized service, use data-driven insights, and embrace technology will thrive in the evolving housing finance landscape. With Nimokey, advisors can access digital tools, calculators, and insights that enhance credibility and help deliver smarter, faster, and more customer-centric loan solutions.

About Ayushi Payal

Real estate expert with over 10 years of experience helping clients navigate the property market. Specializing in selling tips and market analysis.