7 Smart Financial Habits Every Home Buyer Should Build Before Applying for a Loan

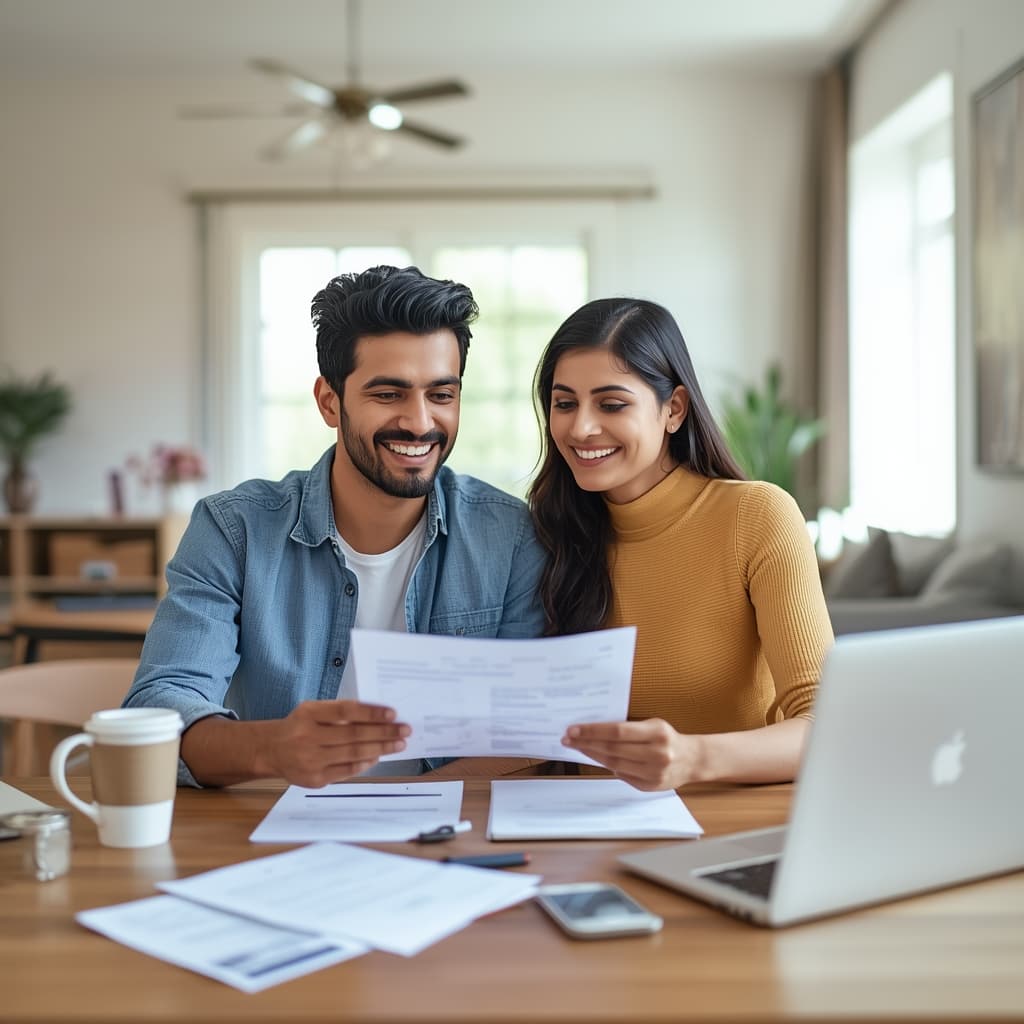

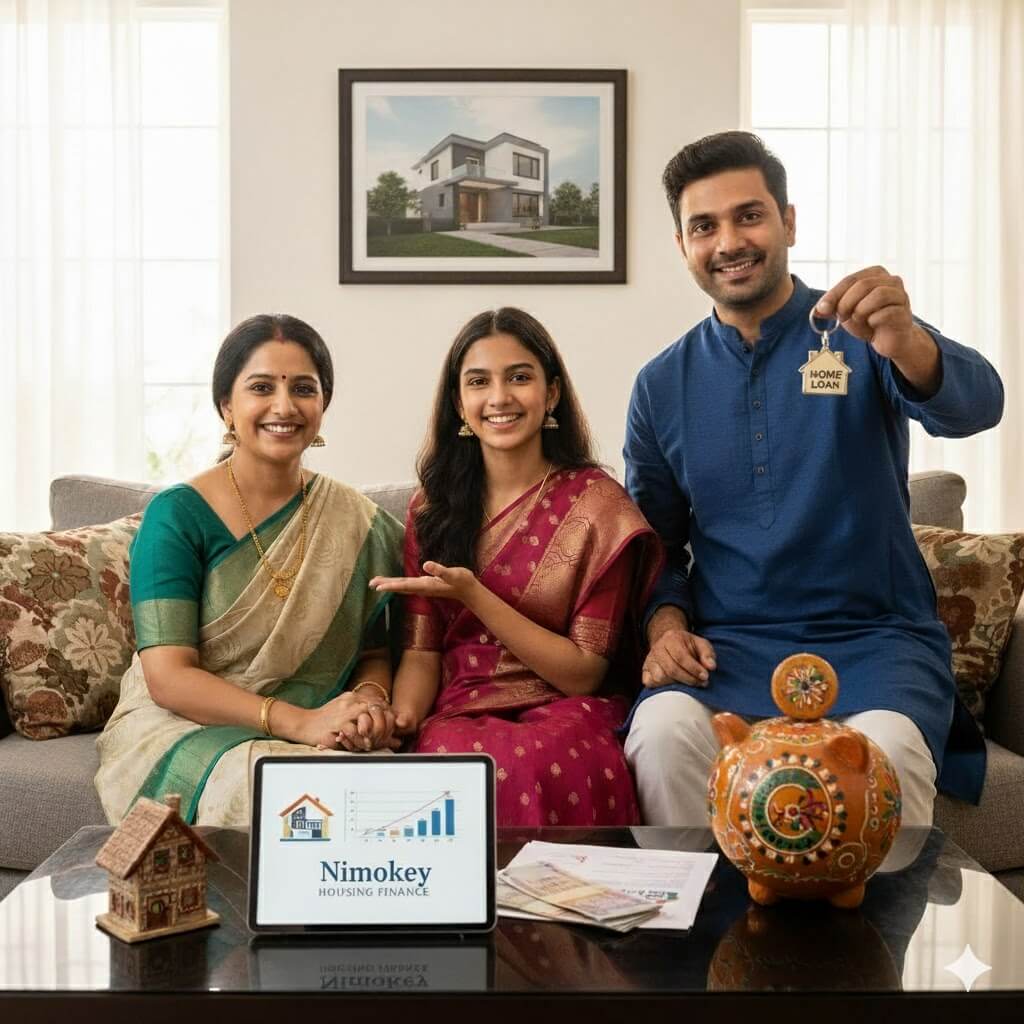

Buying a home starts long before you choose a property. Building the right financial habits early can make your loan approval smoother and stress-free.

Buying your first home is not just about finding the right property it's also about being financially ready for the responsibility that comes with it. Many buyers rush into the process without preparing their finances, which can lead to delays, rejections, or unnecessary stress. Building a few simple money habits can make the entire journey easier and more rewarding.

1. Track Your Monthly Spending

Understanding where your money goes each month helps you make smarter financial decisions. Use an app or notebook to track your income and expenses. When you know your spending patterns, you can identify areas to save more for your down payment.

2. Pay Off High-Interest Debts

Before you apply for a home loan, try to clear credit card balances and personal loans. Reducing your debt improves your credit score and increases your chances of getting a better interest rate on your home loan.

3. Build an Emergency Fund

Unexpected expenses can appear anytime from job changes to medical bills. Having a safety fund with at least 3-6 months of living costs ensures that you can manage your EMI payments even in difficult times.

4. Keep a Consistent Income Record

Banks prefer stability. If you're planning to change jobs, it's best to do so well before applying for a loan. A steady income history for at least 6-12 months builds confidence for lenders and makes the approval process smoother.

5. Avoid Unnecessary Large Purchases

Try not to buy expensive gadgets, cars, or take new loans just before applying for a home loan. These can increase your debt-to-income ratio and make lenders hesitant to approve your application.

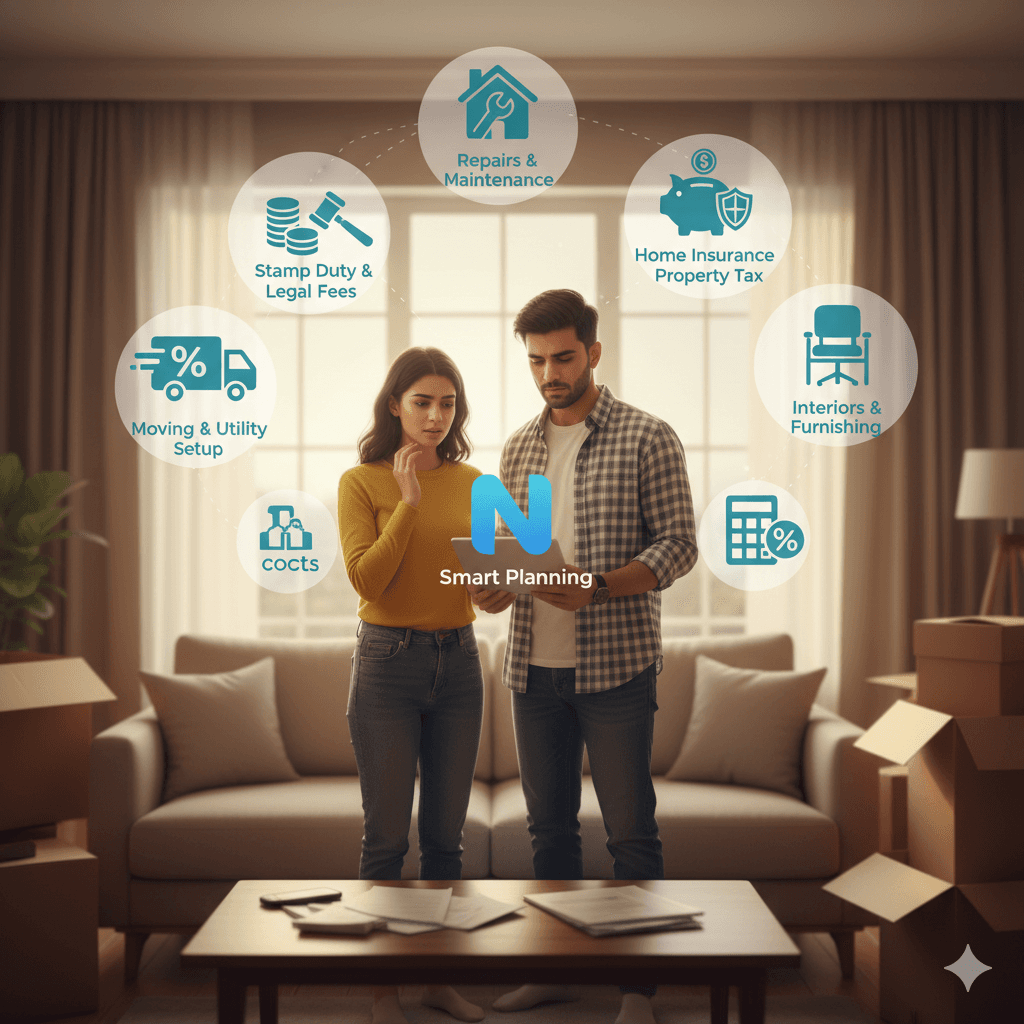

6. Save for Upfront Costs

Down payment, registration, insurance, and moving expenses can add up. Start saving early and set a clear savings goal. The larger your down payment, the smaller your EMI and interest burden will be.

7. Check and Improve Your Credit Score

Your credit score reflects your borrowing behavior. Check it regularly and take action if it's low. Paying bills on time, maintaining low credit card balances, and avoiding unnecessary loans will steadily improve your score.

Conclusion

Good financial habits are the foundation of stress-free home ownership. By managing your money wisely and preparing in advance, you don't just buy a house you build long-term financial confidence. Start today, and when the right home comes along, you'll be more than ready to make it yours.

About Ashish Panwar

Real estate expert with over 10 years of experience helping clients navigate the property market. Specializing in buying guide and market analysis.