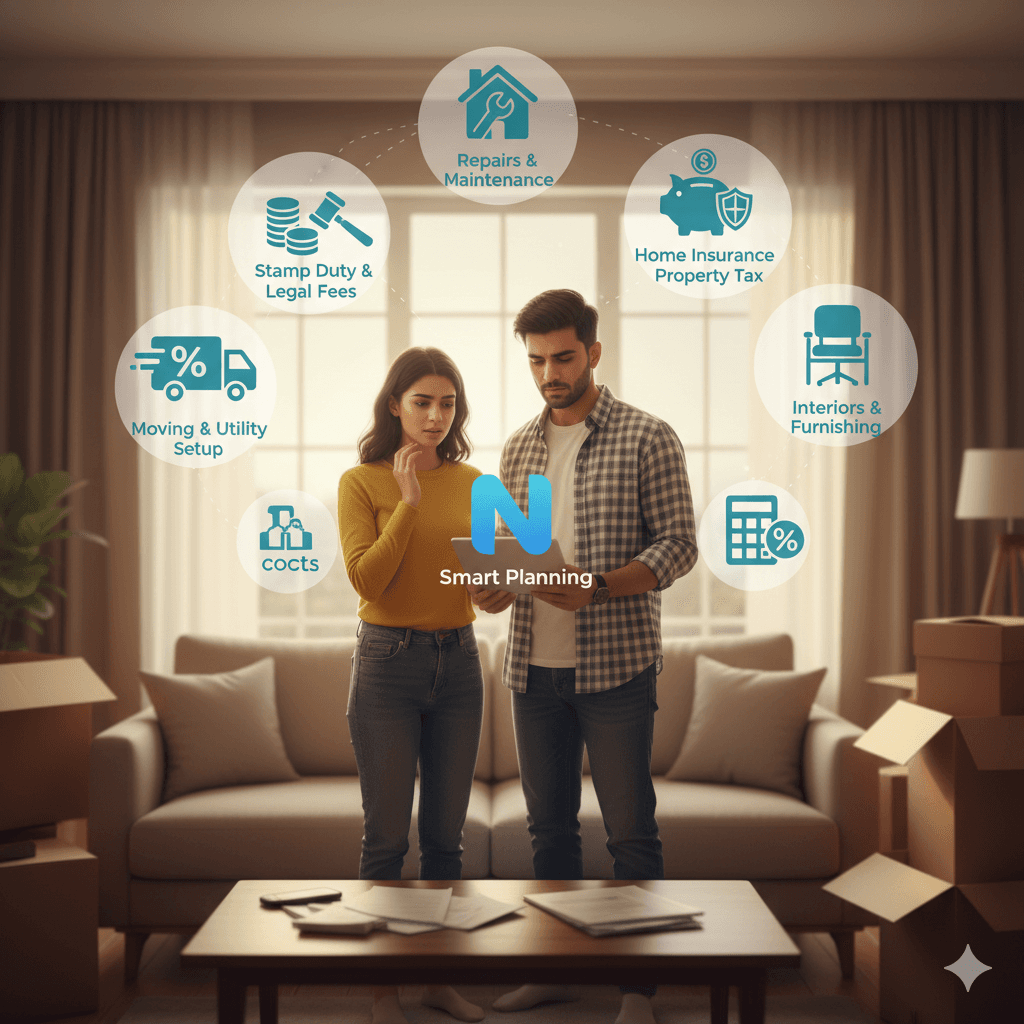

Hidden Costs in Home Buying: What Most Buyers Overlook

Buying a home involves more than just the property price. Discover the hidden costsfrom registration and taxes to maintenance and insurancethat most buyers overlook when planning their home purchase.

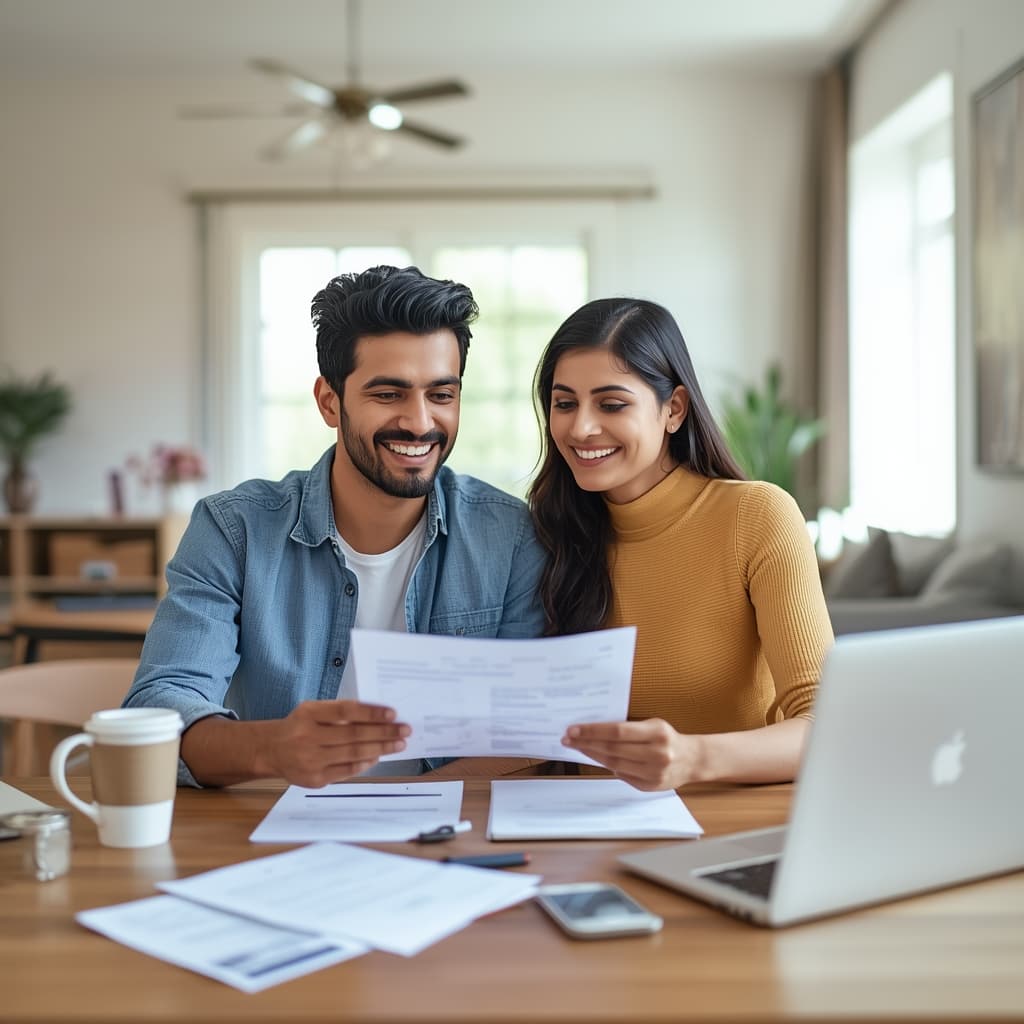

For many Indians, buying a home is a milestone dreambut one that often comes with unexpected financial surprises. While most buyers focus on the property price and home loan, several additional expenses can significantly affect the total cost of ownership. In 2025, being aware of these hidden costs is crucial for smart financial planning. Nimokey highlights the common overlooked charges every homebuyer should factor in before signing the deal.

1. Stamp Duty and Registration Charges

These are mandatory government fees paid during property registration. Depending on the state, stamp duty can range between 5%7% of the property value, while registration charges add another 1% or more.

- Example: On a ₹50 lakh property, stamp duty and registration can cost an additional ₹34 lakh.

- Women homebuyers may get concessions in certain states.

- Always verify current rates with your local sub-registrar office.

2. GST and Applicable Taxes

For under-construction properties, buyers must pay Goods and Services Tax (GST), typically 5% on non-affordable housing and 1% on affordable housing. However, ready-to-move-in homes with occupancy certificates are exempt from GST.

- Clarify tax liabilities before booking an under-construction property.

- Check if the developer passes on any tax benefits or exemptions.

3. Maintenance and Society Charges

Developers often charge a one-time maintenance fee for 12 years in advance. This covers the upkeep of common areas, security, elevators, and amenities.

- Review the terms of maintenance fees before possession.

- Monthly society maintenance can range from ₹2 to ₹10 per sq. ft., depending on facilities.

- Check if maintenance charges increase annually.

4. Parking and Clubhouse Fees

Covered parking, open parking, and club membership often come at an extra cost that's not included in the base property price.

- Covered parking can cost ₹25 lakh per slot in urban areas.

- Clubhouse or amenity fees are usually non-refundable.

5. Interior, Furnishing, and Customization

The cost of turning a bare apartment into a livable home can be significant. Many buyers underestimate expenses for furniture, fixtures, or interior work.

- Plan at least 1015% of property value for interiors and furnishings.

- Compare quotes from multiple vendors to stay within budget.

6. Legal and Documentation Fees

Hiring a property lawyer for title verification, sale deed review, and agreement drafting adds a few extra costsbut ensures safety against legal risks.

- Legal fees may range from ₹10,000 to ₹50,000 depending on property type.

- Always verify ownership and encumbrance certificates before purchase.

7. Home Loan Processing and Insurance

Banks and NBFCs charge processing feestypically 0.25% to 1% of the loan amount. Additionally, buyers may be advised to take home loan insurance or property insurance for protection against unforeseen events.

- Compare loan offers from multiple lenders for lower fees.

- Use Nimokey's Home Loan Calculator to include these costs in your planning.

8. Utility and Possession Charges

Before possession, buyers might have to pay charges for water, electricity connections, or infrastructure development. Some developers also levy administrative possession fees.

- Ask for a detailed break-up of possession-related expenses.

- Clarify if any deposits (like water/electricity) are refundable.

Conclusion

Understanding hidden costs helps buyers avoid last-minute financial strain and make informed investment decisions. By budgeting for these expenses in advance, you can ensure smoother possession and long-term satisfaction. Platforms like Nimokey provide insights, calculators, and expert tools to help you plan every detail of your home-buying journey.

About Ayushi Payal

Real estate expert with over 10 years of experience helping clients navigate the property market. Specializing in buying guide and market analysis.