Common Mistakes to Avoid When Taking a Home Loan

Learn the key pitfalls borrowers must avoid when taking a home loan in 2025. Nimokey guides you through smart practices to ensure smooth approvals, manageable EMIs, and long-term financial stability.

Home loans are a critical financial commitment, and mistakes during the process can lead to higher costs, delays, or stress. In 2025, with evolving loan structures, digital platforms, and flexible repayment options, borrowers need to stay vigilant. Here's a guide from Nimokey on the most common mistakes and how to avoid them.

1. Ignoring Your Credit Score

Many borrowers overlook the importance of a strong credit score. A low score can lead to rejection or higher interest rates. Always check your credit report before applying and address any discrepancies. Maintaining a good score ensures smoother approvals and better loan terms.

2. Not Comparing Lender Offers

Accepting the first offer without comparison is a common mistake. Different banks and NBFCs offer varying interest rates, processing fees, and tenure options. Use tools like Nimokey Home Loan Calculator to compare EMIs and total interest across multiple lenders before finalizing a loan.

3. Overestimating Loan Eligibility

Borrowers often assume they can afford a higher loan amount than they realistically can. Lenders consider income, existing debts, and repayment capacity. Overestimating eligibility can lead to unmanageable EMIs and financial stress. Always calculate your EMI-to-income ratio carefully.

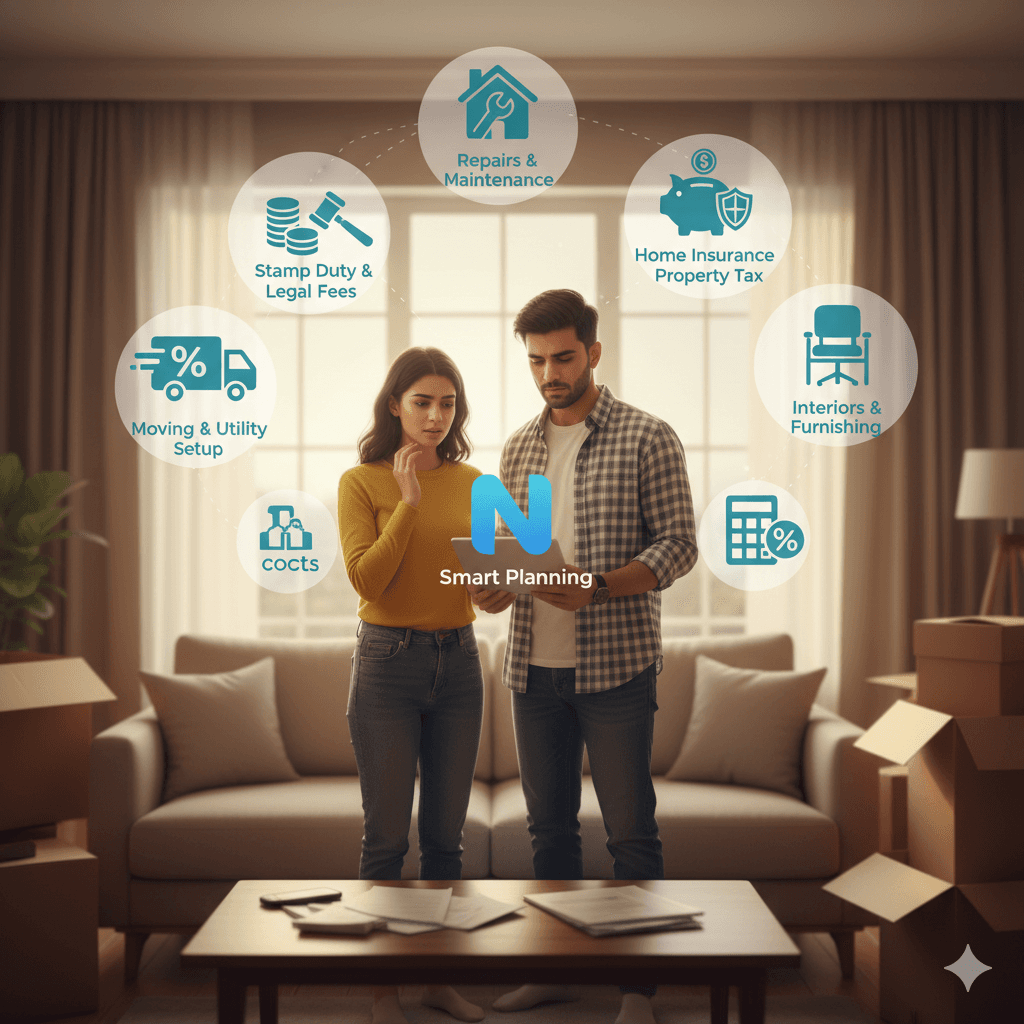

4. Ignoring Hidden Fees and Charges

Processing fees, prepayment penalties, late fees, and other hidden charges can significantly increase loan costs. Read the fine print and clarify all costs upfront. Transparency ensures you are not surprised by additional financial burdens.

5. Choosing the Wrong Interest Rate Type

Failing to understand the difference between fixed, floating, or hybrid rates can affect EMIs and total interest. Fixed rates offer stability, while floating rates may save money if market rates decline. Assess your risk tolerance and consult tools like Nimokey to select the right rate type for your needs.

6. Not Planning for Future Financial Changes

Life events such as job changes, income fluctuations, or family expansion can impact your ability to repay. Borrowers should plan EMIs within a buffer, ensuring sustainability even if circumstances change. This avoids defaults or financial stress later.

7. Neglecting Loan Tenure Implications

Longer tenure reduces EMIs but increases total interest. Conversely, shorter tenure increases EMIs but lowers interest outgo. Balancing tenure with affordability is crucial. Nimokey's calculators can help simulate different scenarios for optimal decision-making.

8. Failing to Review Documentation Carefully

Errors in application forms, KYC documents, or property papers can delay approval. Double-check all submissions to avoid rejections or prolonged processing times. Digital platforms like Nimokey streamline documentation checks for accuracy and completeness.

9. Avoiding Prepayment and Balance Transfer Options

Many borrowers are unaware of prepayment facilities or balance transfer options that can reduce interest outgo. Strategically using these options when possible helps save money and shorten loan tenure.

10. Not Seeking Expert Guidance

Taking a home loan is a complex financial decision. Consulting with financial advisors or using expert platforms like Nimokey ensures informed choices. Professional guidance helps avoid costly mistakes and simplifies the process.

Conclusion

A home loan is one of the most significant financial commitments a person can make. Avoiding these common mistakes ensures a smooth approval process, manageable EMIs, and long-term financial stability. By leveraging tools and guidance from Nimokey, borrowers can make smarter, confident decisions in 2025 and beyond. Remember, careful planning and informed choices are the keys to a successful home loan journey.

About Ayushi Payal

Real estate expert with over 10 years of experience helping clients navigate the property market. Specializing in buying guide and market analysis.